Brazil’s PET Recycling Market: Current Landscape and Key Opportunities in South America’s Green Transition

As the largest economy in South America, Brazil is emerging as a key player in the region’s circular economy. With expanding consumer markets and rising sustainability awareness, the PET recycling sector is gaining strategic importance. In recent years, Brazil has made visible progress in PET waste recovery, rPET applications, and policy development—while still facing challenges in efficiency, quality, and governance. This article provides a neutral overview of the market landscape, technology trends, and future opportunities.

Why Brazil’s PET Recycling Market Is Gaining Attention

According to Sustainable Plastics (2024), Brazil recycled around 410,000 tonnes of PET waste in 2024, showing steady year-on-year growth.

Meanwhile, S&P Global (2021) reported that Brazil’s PET packaging recycling rate reached 56.4%, one of the highest in Latin America.

These figures highlight Brazil’s strong raw material base and policy potential, though the recycling sector remains in a developing stage and has yet to reach full maturity.

A Diverse Ecosystem: From Waste Pickers to Corporate Partnerships

Brazil’s recycling structure is built upon multiple layers of participants—from informal waste pickers (catadores) to organized recycling enterprises—creating a complex yet dynamic system.

Role of Waste Pickers and Cooperatives

Data from NGO Recicleiros show that waste pickers handle more than half of collected recyclables in some cities. With growing support from local governments and NGOs, many have joined cooperatives to participate in formal recycling programs, gaining access to training and resources.

Corporate Participation and ESG Integration

Major beverage and food companies are increasingly adopting Bottle-to-Bottle circular systems, using rPET (recycled PET) to meet packaging sustainability goals and align with ESG commitments.

Technology and Applications: From Mechanical to Chemical Recycling

Mechanical recycling—which includes washing, sorting, shredding, and extrusion—remains the dominant process in Brazil’s PET recycling sector.

With ongoing R&D efforts, several companies are also exploring chemical recycling technologies that depolymerize PET back into monomers, enabling the production of higher-purity rPET.

Recycled PET is widely applied in:

- Food & Beverage Packaging – Bottle-to-Bottle systems and clear packaging films

- Textiles – Polyester fibers, sportswear, and backpacks

- Industrial & Construction Materials – Plastic sheets, strapping, and insulation boards

As global demand for recycled-content packaging grows, Brazilian recyclers are moving toward food-grade rPET and other high-value applications.

Industry Highlights: Equipment Modernization and Global Collaboration

In the Brazilian market, many recycling and bottling companies are actively introducing automation and high-efficiency equipment to enhance production capacity and the quality of recycled materials.

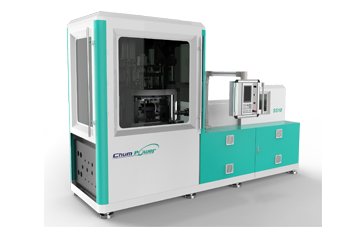

The South American market is seeing a continuous rise in demand for high-efficiency, low-energy consumption bottling equipment, particularly those capable of processing high-proportion recycled materials like recycled PET (rPET). For example, international equipment suppliers such as CHUMPOWER have been promoting their advanced PET blow molding solutions in Brazil for many years. Their technology can effectively support local operators in improving the efficiency and stability of rPET-based bottle production, thus meeting the market's demand for high-value packaging materials.

Key Challenges: Efficiency, Pricing, and Policy Alignment

Despite its strong potential, Brazil’s PET recycling industry still faces several structural challenges:

- Limited collection and sorting efficiency due to fragmented logistics and lack of standardization

- Difficulty integrating informal waste picker networks while ensuring fair labor conditions

- Price competition between rPET and virgin PET during periods of low oil prices

- Inconsistent feedstock quality, making food-grade certification difficult

- Regulatory implementation still underway

According to S&P Global (2025), Brazil is expected to introduce a recycled plastics decree by the end of 2025, setting specific targets for recycling rates and rPET content—potentially marking a new phase of industry formalization.

Outlook: Policy Momentum and Equipment Innovation as Growth Drivers

In line with global decarbonization and circular economy trends, Brazil continues to strengthen its Extended Producer Responsibility (EPR) system and packaging-recycling goals.

For equipment suppliers, recyclers, and brand owners, key opportunities include:

- Investing in automated sorting, purification, and recycling equipment

- Supporting digitalization and standardization of cooperatives

- Adopting chemical recycling to improve material purity

- Building localized Bottle-to-Bottle supply chains aligned with ESG strategies

With policy momentum, infrastructure development, and international technology support, Brazil is well-positioned to become a leading PET recycling hub in South America.

References

- Sustainable Plastics (2024). Brazil recycled 410,000 tonnes of PET in 2024.

- S&P Global Commodity Insights (2021). Brazil’s PET recycling industry struggles with low margins and insufficient supply.

- End Plastic Waste (2024). Instituto Recicleiros Cidades – Brazil Project.

- S&P Global Commodity Insights (2024). Low margins challenge Brazil’s rPET production amid feedstock shortages.

- S&P Global Commodity Insights (2025). Decree regulating recycled plastic in Brazil to be signed in October.